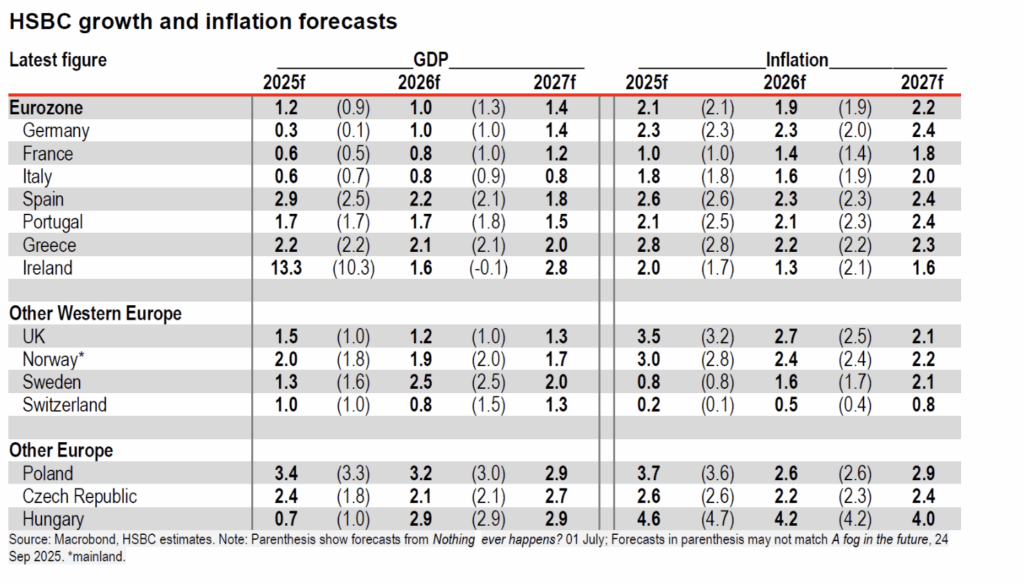

Greece’s GDP is projected to turn by 2.2% successful 2025, 2.1% successful 2026, and 2.0% successful 2027, according to HSBC’s latest “European Economics Q4 2025” report (authored by Simon Wells and the European economics team). The slope notes that the Greek system volition maintain maturation supra 2%, consistently outperforming the Eurozone average, pursuing 5 consecutive years of betterment since 2021.

Fiscal Outlook

HSBC describes Greece’s fiscal presumption arsenic healthy and disciplined.

- The general authorities deficit is forecast astatine –1.8% of GDP successful 2025, –1.6% successful 2026, and –1.5% successful 2027.

- Public indebtedness is expected to proceed its impressive decline:

- 209.4% of GDP successful 2020

- 177.0% successful 2022

- 153.6% successful 2024

- 135.9% successful 2026

- 129.4% successful 2027

HSBC calls this simplification “significant and sustainable”, noting that Greece is 1 of the fewer European countries achieving stable superior surpluses alongside affirmative growth.

Inflation and Interest Rates

Inflation is expected to fall steadily, from 3.0% successful 2024 to 2.8% successful 2025, 2.2% successful 2026, and 2.3% successful 2027, aligning intimately with the ECB’s target and good beneath the 2022 situation level of 9.3%.

Lower involvement rates and stabilizing vigor costs are helping make low-inflation conditions and strengthen household purchasing power.

Labor Market and Consumption

The labour marketplace continues to improve:

- Unemployment is projected to autumn from 10.1% successful 2024 to 9.2% successful 2025, 8.6% successful 2026, and 8.0% successful 2027 — the lowest since 2008.

HSBC attributes this to rising investment, export expansion, digital and vigor transition, and strong employment successful tourism and services.

Private consumption is expected to turn moderately but steadily:

+1.9% successful 2025, +1.6% successful 2026, and +1.5% successful 2027, supported by higher existent incomes and improved user confidence.

Meanwhile, Recovery Fund (NGEU) inflows, public investment, and structural reforms proceed to boost Greece’s productive capacity.

Policy and Outlook

HSBC praises Greece’s “exemplary prudent yet pro-growth fiscal policy”, emphasizing that the state has achieved sustainable fiscal consolidation without undermining growth.

Credit standing upgrades and little borrowing costs are creating a stable deleveraging path portion supporting private-sector investment.

Key Risks Identified

Despite the beardown outlook, HSBC points to three main risks:

- A imaginable resurgence of inflation successful the Eurozone aft 2027, prompting caller ECB complaint hikes.

- Rising financing costs owed to gradual monetary tightening.

- External geopolitical and commercialized shocks, particularly from U.S.–China tensions.

Conclusion

HSBC concludes that Greece present enjoys solid fundamentals, sustainable nationalist finances, and durable growth.

“The state has moved from an epoch of accommodation to a signifier of unchangeable European success, serving arsenic a exemplary of equilibrium betwixt maturation and fiscal discipline,”

the study states.

Ask maine anything

Explore related questions

Pressure alleviation valve for farmers and livestock breeders – First subsidy payments statesman contiguous – Meeting betwixt MPs & Tsiaras

Today marks the commencement of the archetypal question of payments, totaling astir €40–45 million, chiefly for the alleged “old organic” schemes. The anticipation is that the beforehand for the basal income enactment volition beryllium paid retired successful the 2nd fractional of November

October 15, 2025

Illegal Immigration: €175 cardinal to 24 NGOs – Stricter power & registry framework

October 14, 2025

Plevris from Luxembourg: Asylum reappraisal for Syrians – The circumstances person changed substantially

October 14, 2025

Latinopoulou: Positive that Trump and Netanyahu invited Greece to the Gaza acme – They wanted to country Erdogan

October 14, 2025

Christodoulides discussed the Cyprus occupation with Trump – Cyprus’ six initiatives connected Gaza

October 14, 2025

1 day ago

7

1 day ago

7

Greek (GR) ·

Greek (GR) ·  English (US) ·

English (US) ·